Key Strategies for Financial Growth 3246966997

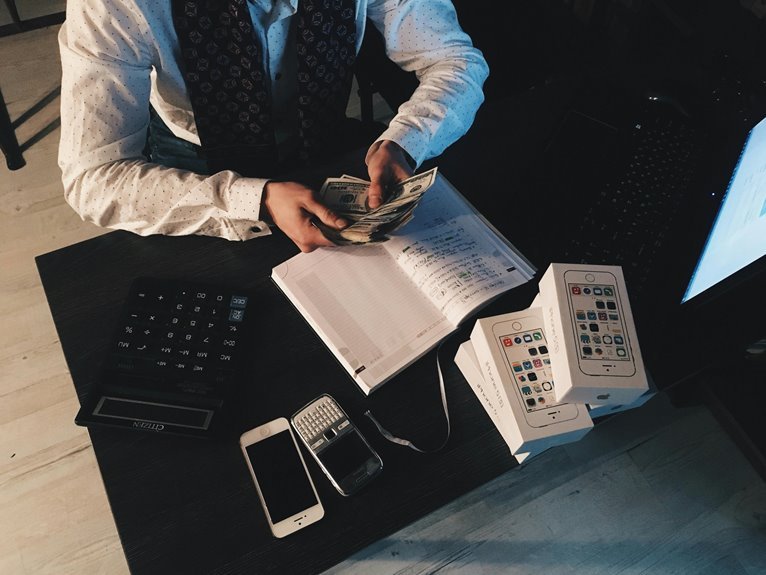

In the pursuit of financial growth, several key strategies emerge as essential. Effective budgeting techniques lay the groundwork for fiscal discipline. Diversifying income streams mitigates risk and enhances stability. Investing in technology can drive efficiency and innovation. Additionally, building strong financial partnerships creates opportunities for resource sharing. Understanding these elements is crucial, yet the interplay between them reveals deeper insights into achieving sustainable growth. What are the underlying factors that influence these strategies?

Effective Budgeting Techniques

How can individuals and organizations optimize their financial resources through effective budgeting techniques?

By establishing clear savings goals and implementing rigorous expense tracking, they can identify unnecessary expenditures and allocate funds more efficiently.

This structured approach not only enhances financial awareness but also empowers individuals and organizations to make informed decisions, ultimately fostering greater financial freedom and stability in their economic pursuits.

Diversifying Income Streams

While many individuals and organizations rely on a single source of income, diversifying income streams presents a strategic opportunity to enhance financial resilience and stability.

By incorporating passive income avenues and engaging in side hustles, individuals can mitigate risks associated with economic fluctuations.

This multifaceted approach not only fosters greater financial independence but also empowers individuals to pursue opportunities that align with their personal aspirations.

Investing in Technology and Innovation

What factors contribute to the successful integration of technology and innovation in financial growth strategies?

Organizations must prioritize digital transformation and leverage tech advancements that enhance efficiency and customer engagement.

Building Strong Financial Partnerships

Building strong financial partnerships is essential for organizations seeking to enhance their growth trajectory and achieve long-term success.

By fostering collaborative networks, businesses can leverage shared resources and expertise, which leads to mutual benefits.

These partnerships not only provide financial support but also open avenues for innovation and market expansion, ultimately driving sustainable growth and empowering organizations to navigate the complexities of the financial landscape.

Conclusion

In conclusion, the pursuit of financial growth necessitates a strategic blend of effective budgeting, diversified income streams, and technological investment. By establishing clear savings goals, tracking expenses diligently, and fostering strong financial partnerships, individuals can enhance their financial acumen. Embracing passive income opportunities, engaging in side hustles, and leveraging innovations further enriches one’s financial landscape. Ultimately, a comprehensive approach not only mitigates risks but also positions individuals for sustained success in an ever-evolving economic environment.