Financial Management for Business Expansion 3509095522

Financial management for business expansion requires a methodical approach. Companies must assess their cash flow to ensure sustainability during growth phases. Strategic budgeting and accurate forecasting are crucial for anticipating financial needs. Additionally, identifying diverse funding sources can mitigate risks inherent to expansion initiatives. A thorough understanding of these elements lays the groundwork for success. However, the complexities involved in investment planning and risk mitigation deserve closer examination.

Understanding Cash Flow Management

While many businesses focus on profitability, understanding cash flow management is crucial for sustaining growth and ensuring operational stability.

Effective cash flow management allows businesses to predict financial health through accurate financial forecasting. By monitoring inflows and outflows, companies can make informed decisions, allocate resources strategically, and maintain flexibility.

This approach empowers businesses to navigate challenges and seize opportunities, ultimately fostering long-term success.

Budgeting and Forecasting Techniques

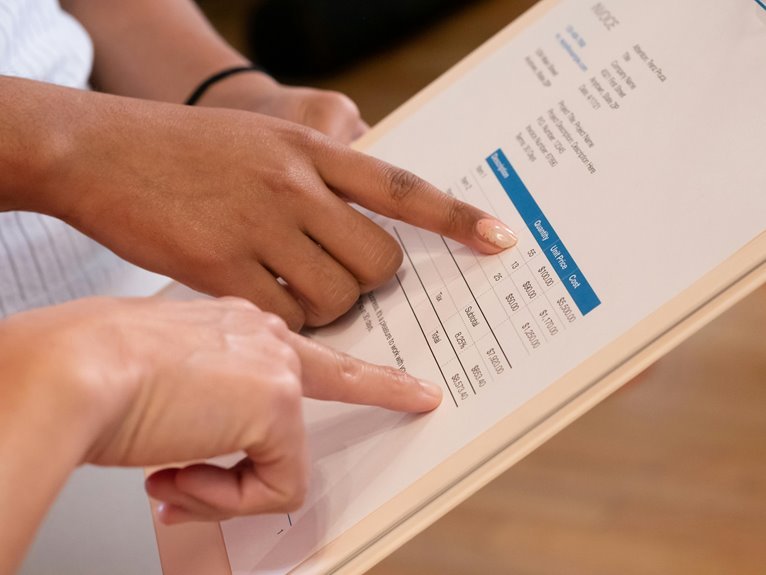

Effective budgeting and forecasting techniques are essential components of financial management that empower businesses to achieve their expansion goals.

By meticulously analyzing cost allocation and developing accurate revenue projections, organizations can strategically allocate resources and anticipate market demands.

This proactive approach not only enhances financial stability but also facilitates informed decision-making, ultimately fostering sustainable growth and enabling businesses to thrive in competitive environments.

Securing Funding for Expansion

How can businesses secure the necessary funding to support their expansion initiatives?

Exploring diverse funding avenues is crucial. Crowdfunding options offer a platform for engaging potential investors, while venture capital presents opportunities for substantial investments from seasoned financiers.

By strategically approaching these funding sources, businesses can enhance their financial capacity, fostering growth and innovation.

Ultimately, this can help realize their expansion goals with increased autonomy.

Investment Planning and Risk Mitigation

As businesses embark on expansion initiatives, careful investment planning becomes essential to ensure sustainable growth and effective resource allocation.

Strategic investment strategies must align with organizational objectives, while thorough risk assessment identifies potential challenges.

By proactively addressing uncertainties, businesses can optimize their investment portfolios, enhancing resilience and flexibility.

This disciplined approach fosters an environment conducive to opportunity, ultimately empowering companies to navigate expansion successfully.

Conclusion

In navigating the intricate landscape of business expansion, effective financial management serves as the compass guiding organizations toward sustainable growth. By mastering cash flow management, employing strategic budgeting techniques, and exploring diverse funding avenues, businesses can not only weather the storms of uncertainty but also seize opportunities for advancement. Ultimately, a well-crafted financial strategy is the bedrock upon which successful expansions are built, transforming aspirations into tangible achievements while mitigating the inherent risks of new ventures.